You may have noticed more volatility in public markets lately - between inflation, rising interest rates, ongoing geopolitical tensions and talk of a recession. Many investors have been turning to alternative assets in search of diversification and steadier returns. But how satisfied are they really, and will appetite stay strong?

We analyzed the latest preview of the annual LP Survey from SS&C Intralinks (produced in association with Private Equity Wire) to find out where investor sentiment stands. This survey polled over 200 limited partners (LPs) worldwide across family offices, pensions, endowments and more.

Here are the key trends and takeaways you need to know.

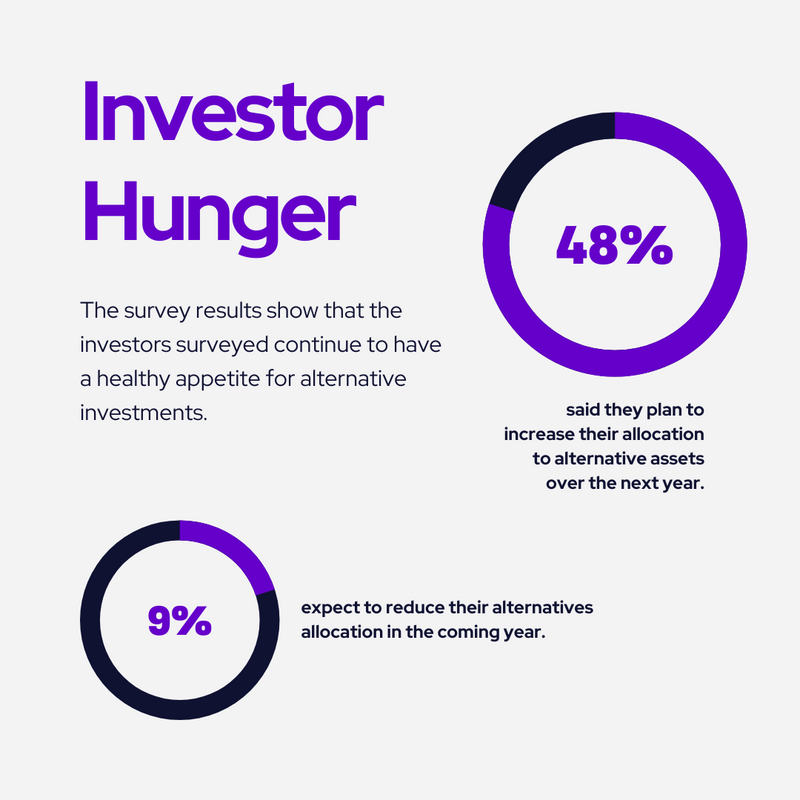

Investor Hunger for Alternatives Isn’t Wavering

The survey results show that the investors continue to have a healthy appetite for alternative investments. Almost half (48%) of the investors surveyed said they plan to increase their allocation to alternative assets over the next year.

This lines up with what we saw in last year's survey, where 71% of investors surveyed were planning allocation increases. So despite any performance concerns, most LPs are still keen to expand their exposure to alternatives.

Not only that, but their level of interest seems to be growing. Over a third (34%) of investors surveyed in the current year want to increase their alternatives allocation by at least 10%. That's up from 32% last year.

This suggests that while some investors may be frustrated with returns, the majority still see major value in adding alternative assets like private equity, private debt, real estate and infrastructure to their portfolios. Likely because these assets demonstrate less correlation to public markets and can improve diversification.

Only 9% of the investors surveyed expect to reduce their alternatives allocation in the coming year. So there continues to be a strong vote of confidence overall in alternatives as an important component of LP portfolios moving forward.

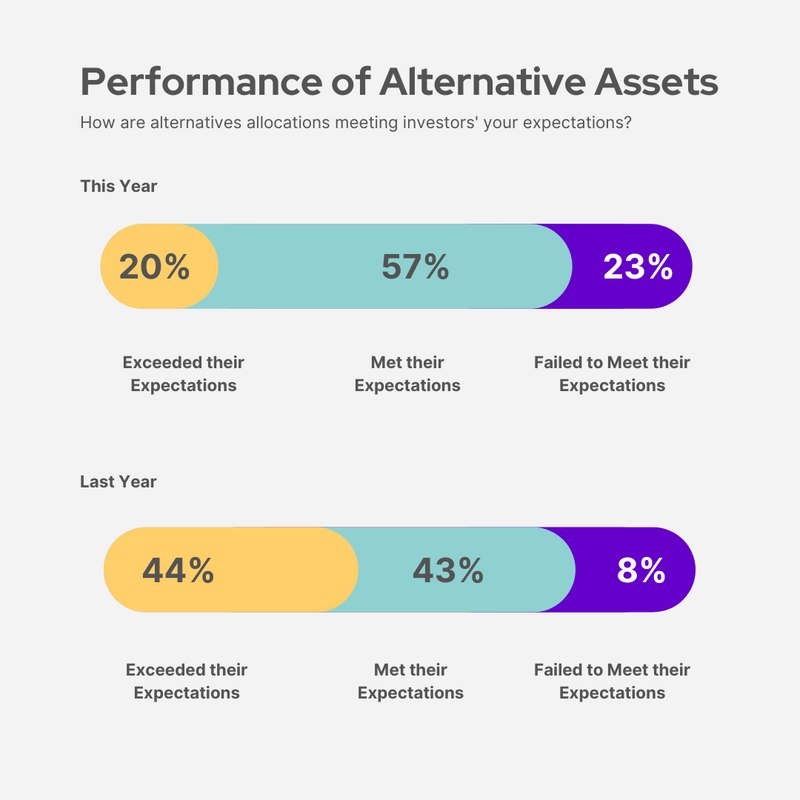

Some Investors are Losing Patience With Performance

Over half (57%) of LPs surveyed said their alternatives allocations met their expectations over the past year. That's better than last year, when only 43% said performance met expectations.

On the contrary, the number of the investors surveyed expressed disappointment this time around. 23% said their alternatives failed to meet performance expectations, up significantly from just 8% last year.

This uptick in dissatisfaction likely comes down to high valuations, dry powder levels, and other factors impacting returns. With the denominator effect squeezing private equity gains, expectations may need to be reset.

For the remaining 20% of investors surveyed, their alternatives allocations actually exceeded expectations and generated strong risk-adjusted returns.

Overall while interest remains high, more LPs are growing impatient with performance than before. General partners can't take continued LP interest for granted.

Delivering transparent value reporting and managing expectations will be key for retaining investors in this environment.

Private Credit Steps Into the Spotlight

One major finding from the survey was the increased enthusiasm for private credit strategies going forward.

A vast majority (71%) of LPs surveyed believe private credit funds will play a significantly greater role in portfolios moving ahead.

Last year, LPs said they were surprised more capital wasn't already flowing into lending strategies. So it's clear that investor appetite for private credit exposure is accelerating.

For LPs, these assets can provide higher yields compared to fixed income. And for borrowers, it offers access to capital that traditional lenders are shying away from right now.

ESG Reporting Remains A Work in Progress

Last year’s survey shows that 49% of the respondents said they planned to increase ESG due diligence with managers. However, over a third shared that they weren't getting meaningful ESG data increases from GPs.

In fact, over a third even said they'd divest entirely from managers that didn't provide an updated ESG policy annually.

Fast forward to this year's findings, and it seems not much has changed. LPs continue to express a desire for improvement on ESG reporting from GPs.

While LPs use varying ESG frameworks, there still lacks consensus around standards. The UN PRI was most used by less than half of investors surveyed.

Once again, limited partner engagement also seems infrequent - with less than a quarter collaborating often with GPs on ESG reporting.

So while LPs express a want for advancement, current ESG practices appear stalled. GPs seem unsure how to move forward in a way that satisfies diverse LP expectations.

The one growing area is impact investing, with 38% of the respondents looking to increase exposure to impact funds in the coming year. This suggests impact strategies could be an ESG bright spot on the horizon.

But overall, this year's survey conveys a similar narrative - LP ESG appetite is expanding faster than GPs are evolving. For managers, getting ESG right remains a work in progress fraught with complexity. But it's one they can't ignore if they want to tap into rising LP demand.

LPs Losing Sleep Over Lower Valuations and Buyout Financing

One major area of concern highlighted in the survey was the decline in private equity valuations and banks pulling back on lending. A significant 91% of investors surveyed said they were worried about falling PE valuations, while 81% of them expressed concern about less buyout financing available from banks.

This apprehension makes sense in today's environment with higher interest rates and lower purchase price multiples. Investors fear private equity firms may have overpaid at the top of the cycle and that lending constraints coupled with lower valuations will pressure returns moving forward.

This one-two punch has clearly impacted LP sentiment in a major way. Managing expectations and communicating value amidst these headwinds will be key for general partners hoping to keep investors satisfied.

Disjointed Systems Frustrate Investors

The survey results indicate that limited partners have some concerns when it comes to the technology capabilities of general partners.

Specifically, LPs expressed dissatisfaction with aspects of GPs' technology related to security and reporting. Data security and governance measures were called out as areas of least satisfaction.

But the biggest frustration for over half of LPs (53%) was having to deal with disparate dashboards and multiple logins to access information. This reflects an increase from 35% last year, showing this pain point is getting worse.LPs are looking for more consolidated access and analytics across their different manager relationships and fund investments. Dealing with fragmented systems is cutting into efficiency.

In fact, almost 40% of LPs surveyed said they are considering using technology solutions to aggregate data across their private market portfolios. This highlights the appetite for better integration.

For GPs, outdated legacy systems and disjointed reporting tools are a liability with sophisticated investors. Taking steps to modernize data platforms, security and governance could go a long way in improving investor confidence and satisfaction.

Key Takeaways for Private Market Managers

This annual LP survey provides valuable insights into investor sentiment and how general partners can strengthen relationships.

A key takeaway is that while appetite for alternatives remains robust, satisfaction has cooled slightly. Nearly 5 times as many LPs plan allocation increases rather than decreases. But dissatisfaction with performance ticked up to 23% from 8% last year.

For GPs, the path forward is clear: listen to LPs and adjust strategies accordingly. Enhance transparency and communications. Seek technology solutions that ease investor pain points around data access and aggregation.

If you want to improve your standing with limited partners, you need to expand your networking sphere, which means that you have to take advantage of more networking opportunities with limited partners. Our conferences are the perfect opportunity for you to build meaningful relationships with partners and meet new potential investors or enhance your relationships with current ones.

You can also explore our upcoming webinars for discussions on the latest trends, challenges, and opportunities in the PE and VC industry.