As private equity and venture capital-backed companies look to expand globally, they are exposed to foreign exchange (FX) risk, leading to potential negative effects on the performance of PE and VC funds.

In this interview with Anders Nicolai Bakke, Founder and CEO at Just Financial, we explore the impact of FX costs on portfolio companies and the challenges investors may face in managing them. We also discuss successful FX cost reduction strategies that PE managers can employ and the advantages of Just Financial’s flagship product, FX Analytics.

How does foreign exchange (FX) affect the performance of private equity (PE) and venture capital (VC) firms?

PE and VC-backed companies are intended for expansion and are expected to eventually operate globally, beyond their domestic markets. Once a company sets up a cost base, generates a revenue stream, or provides internal loans in a currency other than its base currency, the business becomes exposed to foreign exchange (FX) risk and potential significant FX costs.

The impact of FX costs in portfolio companies on the performance of PE and VC funds can be negative, leading to reduced investment returns, increased currency risk, hidden costs, difficulty in accurately valuing portfolio companies, and reduced investor confidence. To minimize these risks and maximize returns for investors, PE and VC funds must ensure that portfolio companies actively manage FX costs through best practices, data and analytics.

What are the primary difficulties associated with controlling portfolio FX cost for investors, and what are the key challenges they may face while managing it?

Many fast-growing businesses lack sophisticated finance and treasury functions, making them vulnerable to being identified as easy markup targets by FX liquidity providers such as banks and brokers. These providers can distinguish businesses without access to market data terminals, those that trade with only a single or few counterparties, and those that view FX costs as just another business expense.

The reality of over-the-counter financial markets like FX is that the party with more information always exploits information asymmetry, leading to price discrimination. It is not uncommon for the FX margin to differ up to 25x for two identical companies, with one having access to market data and the other not. In numerical terms, this implies that for two companies trading an annual volume of EUR 50 million, one may incur fees of EUR 300,000 while the other pays only EUR 12,000. Multiplied across a portfolio - this can amount to large numbers of unnecessary fees, fees that easily can be avoided.

Why is cross-portfolio management significant for mitigating FX risk and reducing FX cost

A portfolio can be a source of strength. PE/VC managers can use cross-portfolio thinking to minimize FX risk and lower FX costs. For instance, they can negotiate better margins with banks using data/analytics and by utilizing the combined FX volume of the portfolio. Banks that provide fair margins to portfolio companies may receive a larger share of the annual flows. Cross-portfolio thinking can lead to more effective FX risk management practices by enabling businesses to exchange hedging and execution strategies and analyze data for potential optimizations throughout the portfolio.

What are some examples of successful FX cost reduction strategies PE managers can employ on behalf of their portfolio companies?

A successful approach for decreasing FX costs is to establish a direct relationship between the portfolio company and the FX desk at its bank. Avoiding international payments through domestic bank accounts can save a considerable amount of money as it is the costliest transaction for businesses and generates significant revenue for banks.

Once the business has trading lines, the focus should be on negotiating a fair margin regardless of the FX pair or instrument being traded. Trading through a multibank/auctioning platform is an effective way to achieve this, but it is typically only accessible to companies trading more than EUR 350 million annually.

For businesses trading less than the multibank platform cap or only having lines with a few counterparty banks, utilizing data and analytics to optimize pricing agreements with the bank is crucial to prevent exploitation and discriminatory pricing practices.

In what ways does Just Financial support PE/VC firms in reducing FX cost?

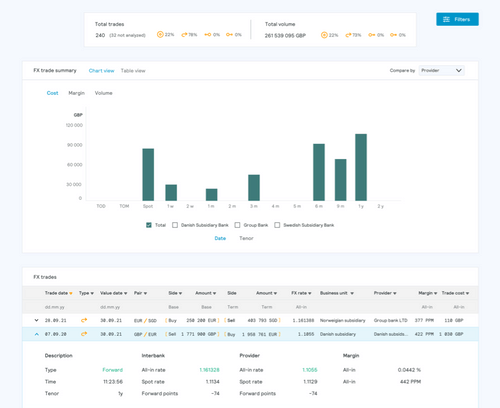

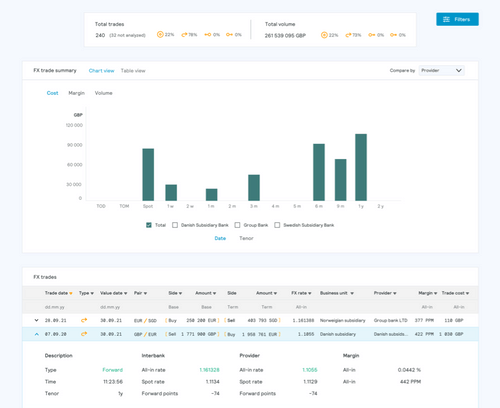

Just's flagship SaaS product, FX Analytics, serves as a versatile operational tool for both portfolio finance/treasury teams, as well as PE managers that want to understand how to drive FX cost efficiency across their entire portfolio.

At the operational level, FX Analytics enables the treasury team to benchmark and analyze FX pricing and trends across pairs, instruments, subsidiaries, and banks in real-time, as well as historically. This empowers companies to secure fair and transparent rates when executing with their banks. On average, businesses across Europe who use FX Analytics have been able to reduce their FX costs by 50-60% annually. Moreover, the product requires no integration or implementation to get started, and normally sees value with less than 3 man-hours invested in the product.

When implemented across all FX-exposed companies in a portfolio, FX Analytics can assist PE managers in understanding the aggregated exposure and risk across the portfolio, as well as portfolio-wide trading patterns and transaction costs. These insights can be leveraged to drive substantial FX saving initiatives across the portfolio in a centralized, low-touch manner. Additionally, best practice playbooks can be developed and rolled out based on the data and analytics delivered.

Beyond its utility as an operational and portfolio-level tool, FX Analytics can also serve as an audit tool to uncover hidden FX costs during a buy-side due diligence process, or as evidence of FX cost efficiency during a sales process data-room. Overall, FX Analytics is a powerful and flexible tool for PE firms, as well as their portfolio companies seeking to optimize their FX management, improve transparency, and achieve significant cost savings.

What advantages does FX Analytics offer over traditional methods and why should businesses consider using it?

Large enterprises typically maintain multiple bank relationships and employ sophisticated multi-bank FX trade applications to facilitate competitive bidding between their banks. This approach yields almost complete price transparency, allowing them to make informed decisions and achieve the best possible pricing.

Just FX Analytics is a comprehensive analytics solution that provides access to market data and employs sophisticated techniques to identify and visualize the hidden costs associated with FX trading. Although it is not a trading platform and does not facilitate trade execution, the insights and results it provides can be used to drive data-informed negotiations with counterparty banks and ultimately lead to reduced costs, on the same level as those large enterprise companies using multi-bank platforms.

Using Just FX Analytics, customers can easily gain a comprehensive understanding of their bank share of wallet, compare pricing between different banks, and make informed decisions when negotiating with counter-parties. This solution is unparalleled in its power and user-friendliness, providing a super intuitive UI and user experience delivered directly to the browser.

It's worth noting that Just FX Analytics is unlike any other solution available outside the trading desks of tier 1 banks or sophisticated hedge funds. It offers a first ROI in the 4-6x range, which is truly unprecedented.

Conclusion

In addition to discussing topics like actively managing FX costs and other private equity and venture capital trends, our conferences provide a unique opportunity for investors to connect with industry leaders and network with like-minded professionals. At our upcoming 0100 Conference Europe, for example, attendees will have the chance to meet Anders Nicolai Bakke, Founder/CEO at Just Financial, and personally discuss FX Analytics and other valuable tools for managing portfolio risk. Don't miss this opportunity to gain insights and make valuable connections in the private equity and venture capital industry.

As a token of our strong partnership, Just Financial is delighted to extend a special offer to all conference registrants, granting you a complimentary trial of their innovative FX Analytics. Join their mission to empower treasurers with complete transparency and control over FX Costs. Simply scan the QR code at the top of the page or visit their website to register and claim your offer today.

By actively managing FX costs, PE and VC funds can reduce the negative impact of foreign exchange risk on their portfolio companies. Tools like Just Financial's FX Analytics can provide valuable insights into portfolio-wide exposure and trading patterns, helping PE managers to understand the aggregated risk and drive substantial FX saving initiatives across the portfolio.