As expected, 2023 marked a period of correction in the venture capital (VC) markets, characterized by a decline in valuations globally due to changing macroeconomic conditions, according to PitchBook European VC Valuations Report 2023. As we step into 2024, three Rs are anticipated to shape VC activity: rates, recovery, and rationalization.

Performance by stage

In 2023, the pre-seed stage demonstrated remarkable resilience, boasting a robust 4.0% YoY increase in pre-money valuation medians, making it the strongest stage in this regard. Additionally, the median deal value saw an 8.4% YoY gain, the second highest among all stages. Performance at the seed-stage market presented a mixed picture. While deal value trends aligned with pre-seed, increasing by 5.3% year-over-year, valuations underwent corrections. The median pre-money valuation declined by 9.2%, reflecting a reduction in overall valuation dispersion within the stage. When it comes to the early-stage VC scene of 2023, there was a 2.8% increase in the median deal value and a 2.5% rise in the median valuation. Notably, the top decile of valuations saw a significant 27.4% decline. AI startups, such as Mistral AI and Helsing, stood out as some of the largest and highly valued early-stage companies, each surpassing a €1 billion valuation. The late-stage VC field had a substantial 11.7% year-over-year increase in the median deal value, marking the largest gain among all stages. While the median pre-money valuation increase was less pronounced, there are positive indicators of resilience both in the short and long term. Finally, venture growth faced significant challenges in 2023, experiencing substantial declines in both deal value and valuations—the only sector in the market to witness such weakening trends. The struggles were fueled by the retreat of tourist investors, weak exit markets crucial for additional financing, and lower public market valuations, which often serve as benchmarks for venture-growth companies. In 2023, the stage recorded a 4.7% decline in median deal value and a 26.2% drop in median valuation year-over-year.

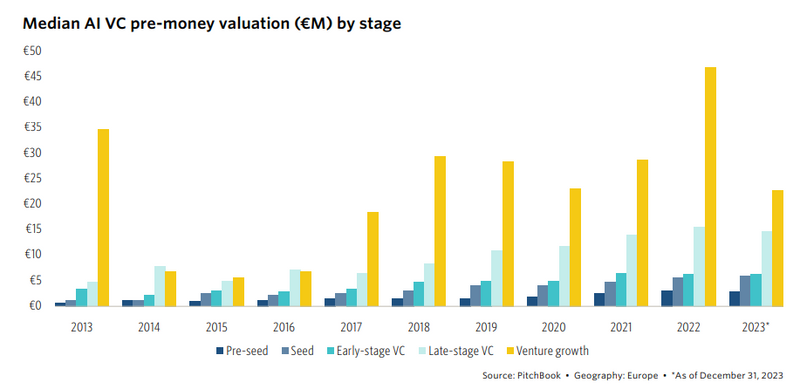

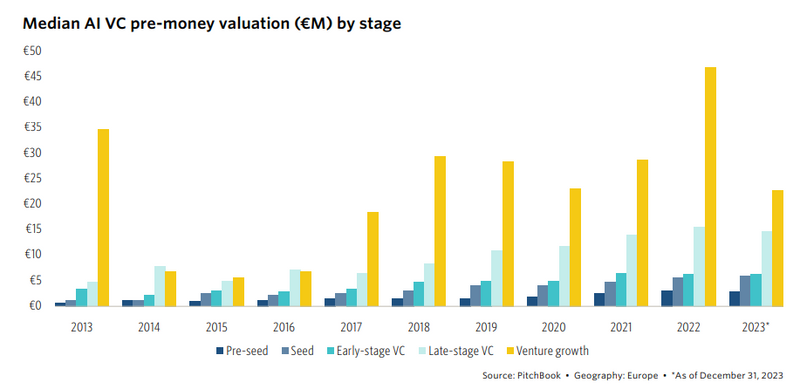

AI and cleantech, the most resilient sectors

In 2023, VC investors deepened their involvement in the realm of AI, which emerged as the focal point of the venture market. Generative AI (GenAI) took center stage, witnessing a surge in startups servicing this space. Despite the heightened interest, the anticipated market hype didn't entirely translate into significant increases in valuation medians. Another highlighted section in the report is Cleantech, which demonstrated notable resilience in deal value and early-stage valuations, despite the challenges of the past year. According to PitchBook, deal sizes within the cleantech sector exhibited a broad increase, except for the early stage, which experienced a YoY decrease.

UK & Ireland, show the most strength

In the UK & Ireland, valuation medians defied broader European market trends, demonstrating noteworthy resilience. Particularly, venture growth in the region exhibited the most robust performance, with the median pre-money valuation showing a significant 4.8% YoY increase.

On the other hand, trends in France & Benelux were almost the inverse of trends in the UK & Ireland. The median venture-growth valuation in 2023 was therefore down 48.8%, and other stages were up. The greatest gainer was early-stage valuations, with the median up 22.2% YoY.

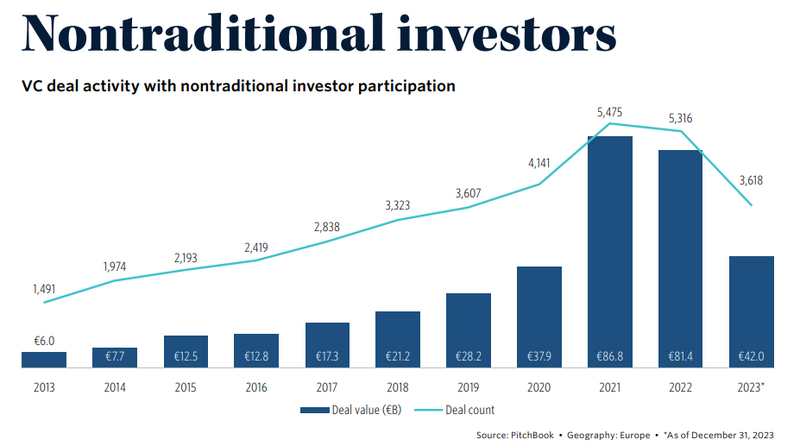

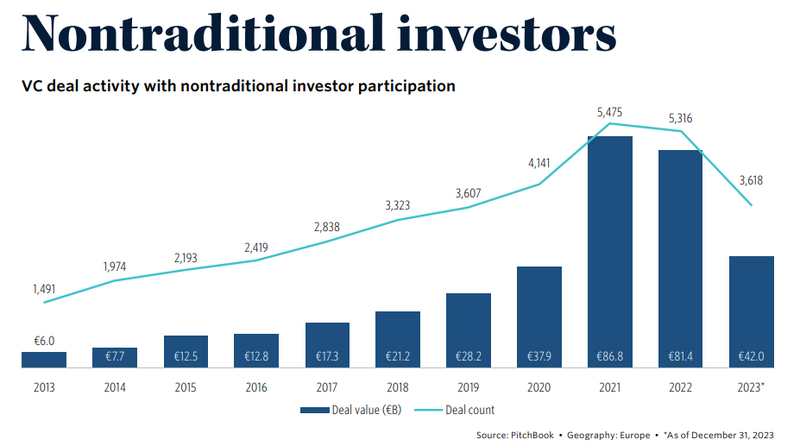

Nontraditional investor

In 2023, nontraditional investor participation in European venture markets experienced a decline, primarily influenced by an overall decrease in VC deal count, reaching its lowest level at 43.5% since 2015. While deal value with nontraditional investor involvement also decreased, it constituted 81.3% of total VC deal value in Europe, a slight drop from 82.5% in 2022 and aligning more closely with 2020 levels. Despite the general decrease in nontraditional investor involvement, certain players, particularly Corporate Venture Capital (CVC) firms, remained active. In 2023, deals with CVC participation accounted for 50.9% of overall Europe VC deal value, up from 48.8% in 2022.

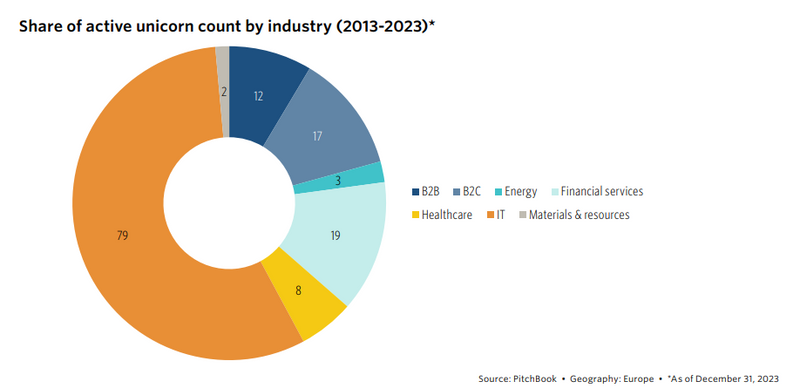

No miracle for unicorns

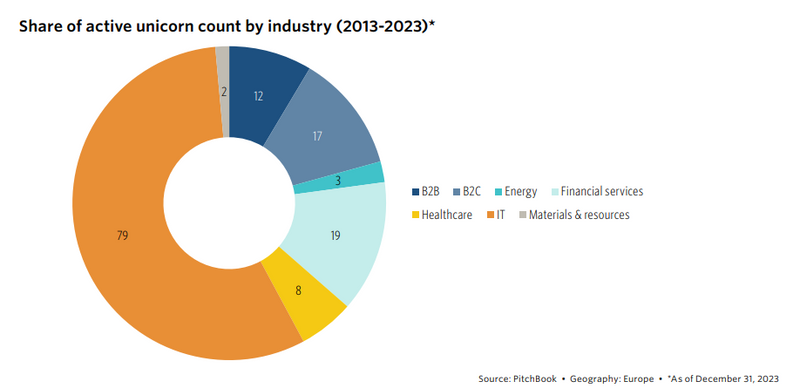

In 2023, there was a significant 77.5% year-over-year decline in unicorn deal value, aligning with expectations. This decline was particularly evident in the venture growth sector, where unicorns typically reside. The most mature segment of the market, which had experienced a surge in nontraditional investors in 2021 and 2022, faced a substantial decrease in deal activity and valuations as these investors exited amid market volatility in 2022 and 2023. Despite this downturn, the year saw the emergence of 12 new unicorns, counterbalanced by eight "de-minted" unicorns – six falling out of status through down rounds and two through bankruptcies. The number of unicorns undergoing down rounds reached a decade high in 2023, reflecting the challenging environment for late-stage players. Nevertheless, the cumulative active unicorn count in Europe increased year-over-year, totaling 140. The majority of these unicorns belong to the information technology (IT) sector, with financial services and B2C sectors following closely. The aggregate unicorn post-money valuation in Europe for 2023 stood at €448.1 billion, slightly down from the 2022 level of €458.8 billion.

Liquidity

In 2023, the median exit valuation settled at €23.0 million, marking a substantial 28.7% year-over-year decline. Notably, the median public listing valuation performed less favorably than acquisitions, experiencing a 60.3% YoY decrease compared to the 25.2% decline for acquisitions. Public listings exhibited a significant compression in valuation dispersion, contrasting with the acquisition market's greater resilience, where the top decile of exit valuations remained relatively stable, and the bottom quartile even saw a YoY increase. Weak public listing activity, reaching a decade-low of €1.4 billion and plummeting 90.2% YoY, contributed significantly to the overall decline in exit values in 2023. Despite a robust pipeline of companies, particularly in the venture-growth sector, the outlook for public listings in 2024 appears uncertain, with expectations of no substantial recovery in value or count. While the market demonstrates a healthy influx of investments, companies are likely to approach public listings cautiously due to uncertain macroeconomic conditions and low visibility in the immediate future.

We are pleased to announce PitchBook as our official Data Partner at the upcoming 0100 Conference Europe, to be held in Amsterdam from April 16th to April 18th. Book your ticket here and elevate your experience with exclusive PitchBook access, available from March 27th to April 19th, 2024. PitchBook provides comprehensive insights and attendees, companies, deals, investors, and funds. Maximize your time at the conference by viewing the attendee list to identify connections, prepare for meetings and enhance networking.