With so much uncertainty still lingering from black swan events of 2021 and 2022, it’s hard to gauge the success factors of Private Equity and Venture Capital Funds. According to a recent Bain midyear report of 2022, what the future holds is unclear and any number of factors could scramble the outlook—the war in Ukraine and election-year politics, to name just two. “But signs suggest that we are approaching the end of the business cycle, and at midyear, we’re already seeing a slowdown in private markets.”

With that being said, how can we access investor sentiment about funds’ performance of their portfolios and indicators of future LP decision-making?

Fortunately, SS&C in association with Private Equity Wire, produced 2023 LP Survey: Key Findings Insights on alternative investments that portrayed some insightful findings that can help GPs and give them the insight to the LP’s mind.

In this article, we’re going to be discussing the key findings of the report and how alternative asset returns are, year-on-year, exceeding investor expectations and building ever-rising confidence in the ability of the asset class to outperform in both bull and bear markets.

Performance Highlights

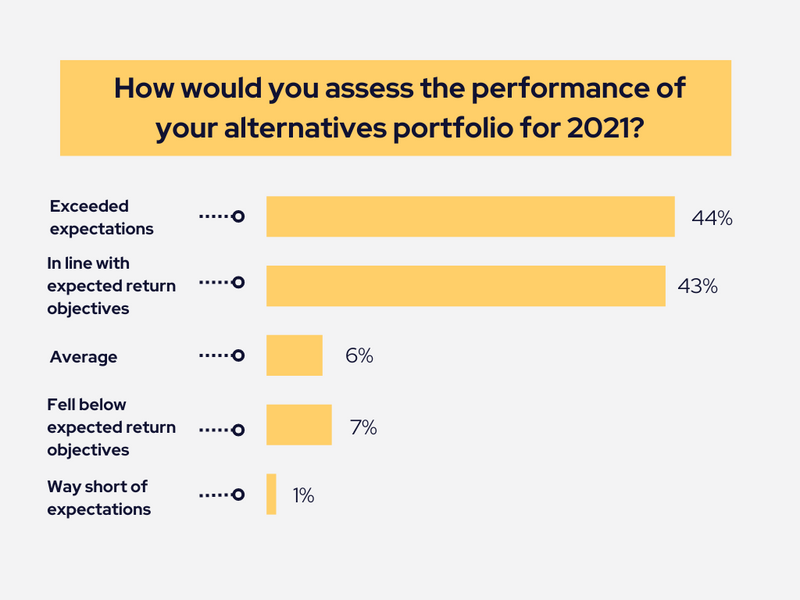

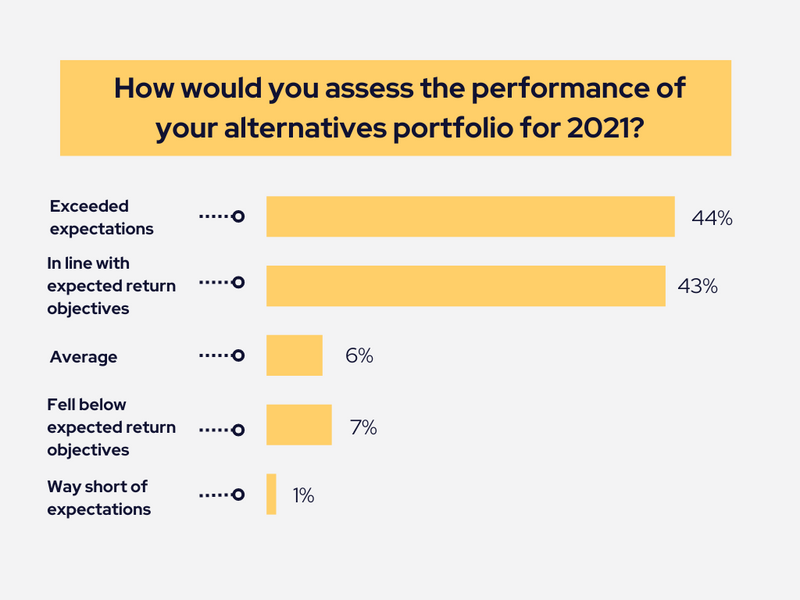

Even though funds have struggled to raise more money against a backdrop of rising interest rates, global geopolitical tensions, and lingering pandemic-related headwinds, according to this report, 86% of investors said performance was in line with or exceeded expectations.

Private equity was one of the best performers, with 36% of investors seeing risk-adjusted returns that outperformed expectations. Hedge funds, on the other hand, slightly underperformed compared to other alternatives such as venture capital.

While the majority of LPs were pleased with their portfolio’s performance, not all LPs shared that sentiment. Just over 7% of investors reported that their alternative portfolio performed below or “way short” of return objectives and expectations.

So what does this all mean for limited partners when it comes to making decisions about their portfolios?

For one, it's important to keep an eye on key indicators that will influence LP decision-making. This includes things like portfolio performance, asset allocation, and return expectations.

It's also important to remember that each LP has different objectives and risk tolerances. So while one may be more inclined to invest in private equity after seeing strong returns this year, another may be more interested in hedge funds because of their lower risk profile.

Allocation to Alternatives

The alternative assets industry has continued to grow in recent years and is now a mainstay of the modern investment landscape. Industry assets under management (or AUM) are at record highs, and investor and fund manager interest in alternatives has increased steadily over time.

It's not surprising to see the use of alternatives in investments on the rise. With big brand investment firms raising ever-larger funds for alternative assets, nearly 18% of those surveyed with current allocations have excess AUM of USD five billion or more.

The shift to alternatives is a long-running trend for a variety of investors, all of which are motivated by different needs specific to their risk/return profiles and investment philosophies.

According to this survey, more than 70% of investors we surveyed said they expected to increase their allocations to alternatives over the next 12 months, with just over 29% saying they would not.

Asset Allocation Trends

Even though private equity remains the most attractive strategy for LPs, only 7% of those surveyed are committing to increasing these investments to 20% or higher. Most investors are looking to increase their private equity investments by less than five percent.

Number of GP Relationships

With fundraising processes pushed into 2023, selecting the right GP can mean the difference between success and failure. Given current geopolitical and macroeconomic uncertainties, it is more important than ever to make sure you don't select the wrong person for the job.

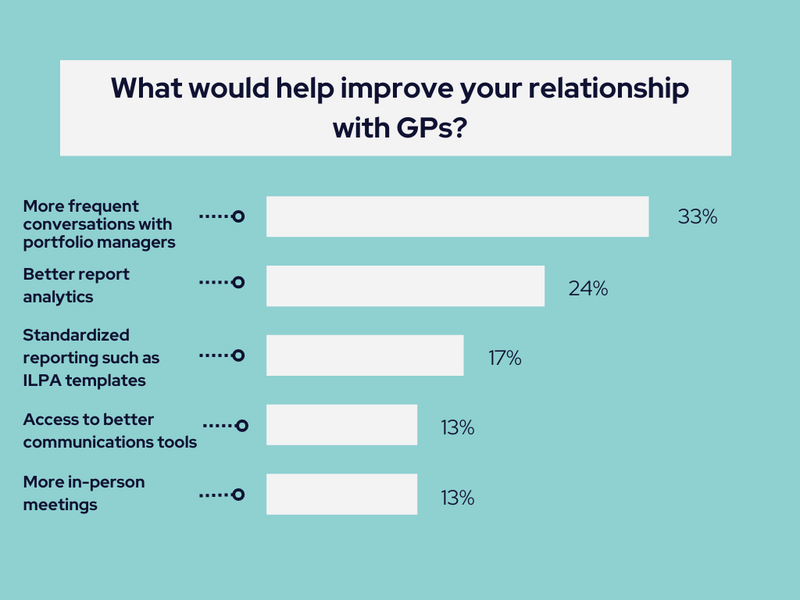

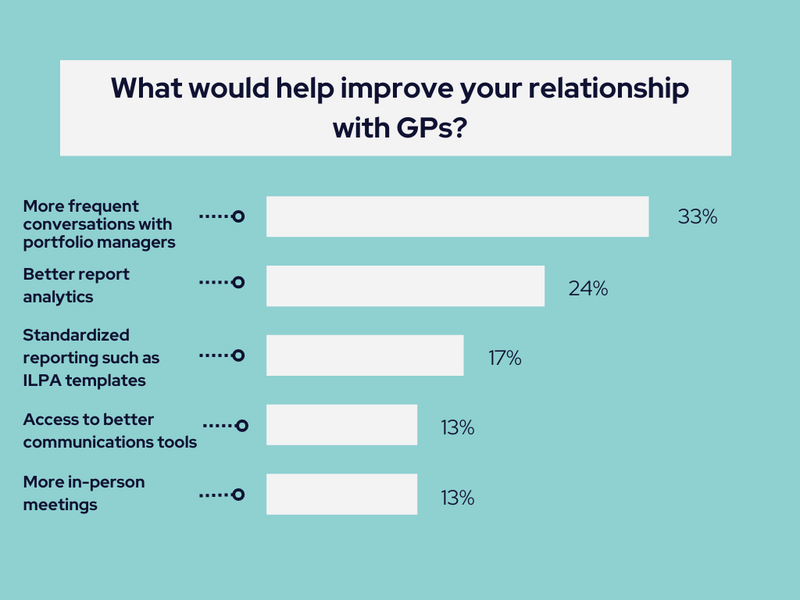

Even though the report shows 53% of LPs planning on increasing the number of GP relationships they have over the next 12 months, investors still see room for improvement in areas such as better-quality reporting, the ability to access quality digital communication tools, standardized reporting with ILPA templates, and more in-person meetings.

Now that borders have opened, there's more opportunity than ever to meet potential investors and show them what you're working on. Attending PE and VC conferences is a sure way to get the attention of potential Investors, as well as networking with LPs.

Luckily, 0100 Conferences holds regular private equity and venture capital networking events that you can attend to have the opportunity to meet potential business partners. Click here to find a conference near you, and start building meaningful relationships

Emerging Managers

As the number of emerging managers continues to grow, so does the competition for limited partner investment. In order to stand out from the crowd, emerging managers need to focus on key indicators that will influence LP decision-making.

According to this survey, the most important factor when considering an emerging manager is a niche strategy with 29% of investors agreeing with this statement.

27% of investors surveyed said the second most important driver is attractive return potential.

Moreover, 33% of investors say they are looking for emerging managers

with a private equity strategy, followed by hedge funds, venture and private debt.

Investors seem hesitant to commit to emerging managers in the real estate and infrastructure segments.

Continuation & Secondary Funds

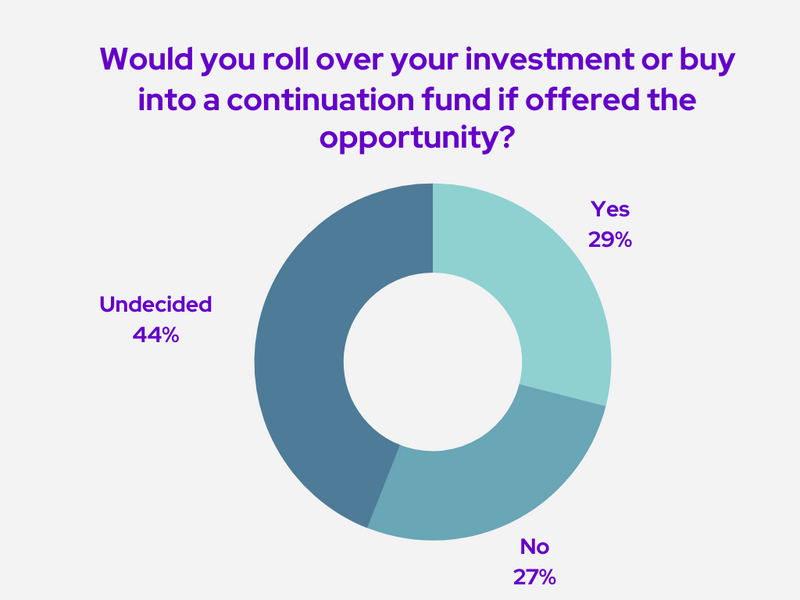

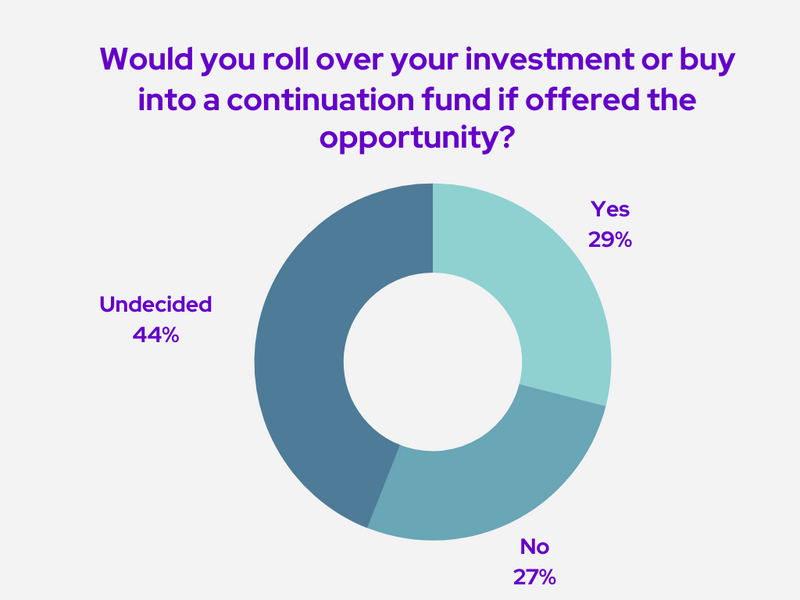

As the GP-led secondaries and continuation funds are on the rise, so does the natural progression of the maturity and diversification of the alternative asset market.

Private equity secondaries are nothing new and have provided a quick exit for LPs when capital calls come due. However, the rise of GP-led secondaries, or "continuation funds" has caused mixed feelings among institutional investors.

One concern is that private market valuations won't be fair if GP's play the role of both buyer and seller. Another worry is that some LPs are getting an unfair advantage over others when it comes to co-investment deals. It might not be long before we start questioning whether these same LPs get an unfair advantage in continuation fund deals.

The survey shows that 29% of investors expect to roll over their investment or buy into a continuation fund if offered the opportunity.

Moreover, those who are currently in the process of selling assets are being advised to take advantage of the still-active M&A market and GP-led secondary market to speed up negotiations in the event of a turnaround.

Because investors, especially those that are co-investing, appreciate that the assets within a fund still have growth potential, investors and GPs alike want to take advantage of this when it's there, so an exit will be reached at the highest point of growth.

How GP-LP Relationships Can Be Improved

One of the key indicators that will influence limited partners' decisions is the level of transparency. GPs need to be transparent about their activities and investments in order to build trust with their LPs.

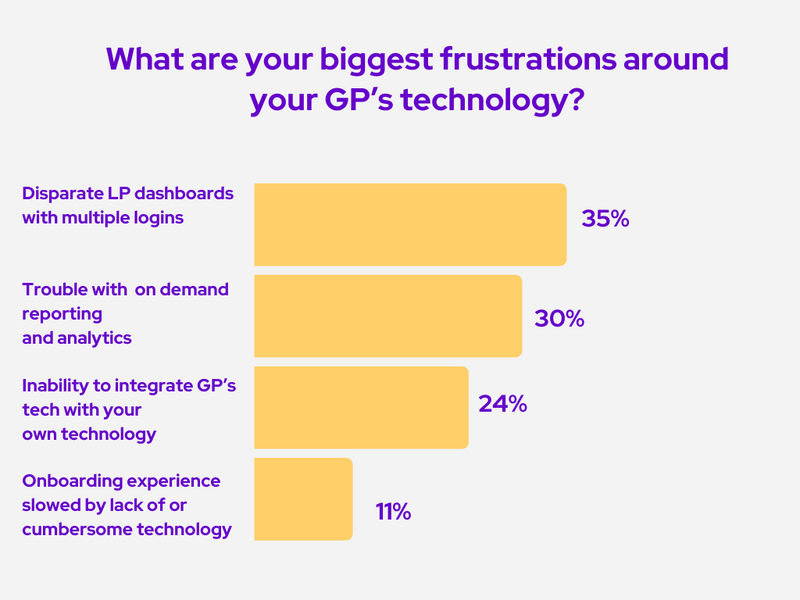

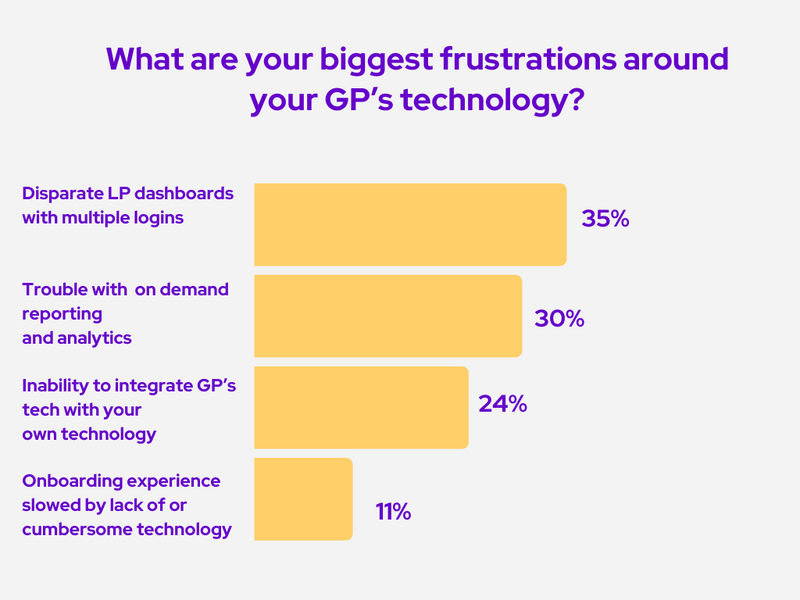

LPs do mention, though, that there are some unsatisfactory capabilities that include accessing reporting and analytics data on demand, or having a bad experience when doing so. However, these problems can be solved by GPs improving their technology- which will give the LPs what they need: access to their investments when it's convenient for them.

It's easy to see that technology, such as bespoke portals and data analysis, is helping GPs maintain a successful LP relationship. Some GPs even outsource these capabilities for better customer service and advanced technology. Vestberry is an example of how some of these tasks can be outsourced efficiently. It automates the LP report process to reduce human error and ensure reliability. This way, your staff has more time to handle other projects. Click here for more info.

When LPs were asked if they considered ESG criteria in the investment process, they responded that this was becoming increasingly important. In many cases, this also aligns with a manager's ability to generate alpha in their funds.

30% of LPs said their GPs could do better when it came to the level of transparency, with just 4% saying that they needed to improve significantly.

Conclusion

In conclusion, this report provides GPs with some useful insights into how they can better satisfy their LPs or find new LPs in these challenging times.

If you want to improve your standing with limited partners, you need to expand your networking sphere, which means that you have to take advantage of more networking opportunities with limited partners. Our conferences are the perfect opportunity for you to build meaningful relationships with partners and meet new potential investors or enhance your relationships with current ones.

You can also explore our upcoming webinars for discussions on the latest trends, challenges, and opportunities in the PE and VC industry.