STORY BEHIND

0100 Conferences has been building its strong presence across Europe for five years, bringing together top tier Limited Partners and General Partners. As one of the leading providers of conferences in several European countries, we saw an ongoing challenge for fund managers in PE market – to get in touch with the right LP, at the right time while fundraising. COVID-19 was a rolling disruption in the PE market and made the situation even harder.

We know that building a network is a tough and time-consuming process. Now, imagine what you could do with access to more LP contacts in the private market than anyone else.

The first wave of COVID-19 got us thinking about how to switch to the digital world, and help to keep the networking between LPs and GPs growing. That was the moment when we decided to transform our complex network built over the last 5 years into an extensive database of investors around the globe. You can now find the right LP that fits your investment strategy within a few clicks. InvestBridge has become part of 0100 Conferences services and offers you data on the global capital market.

MISSION

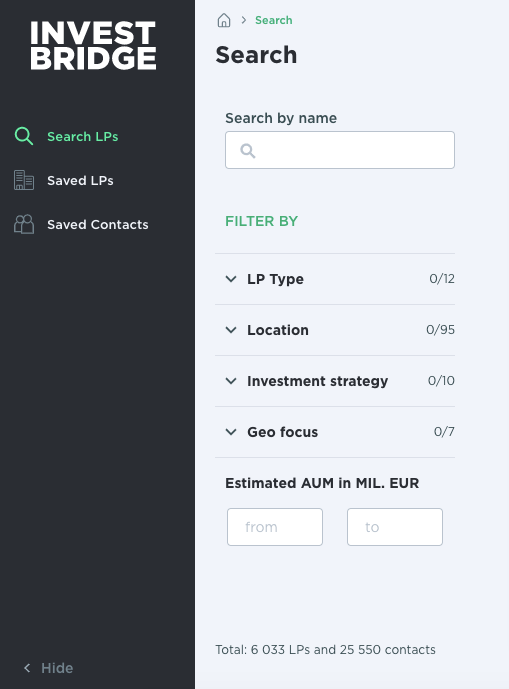

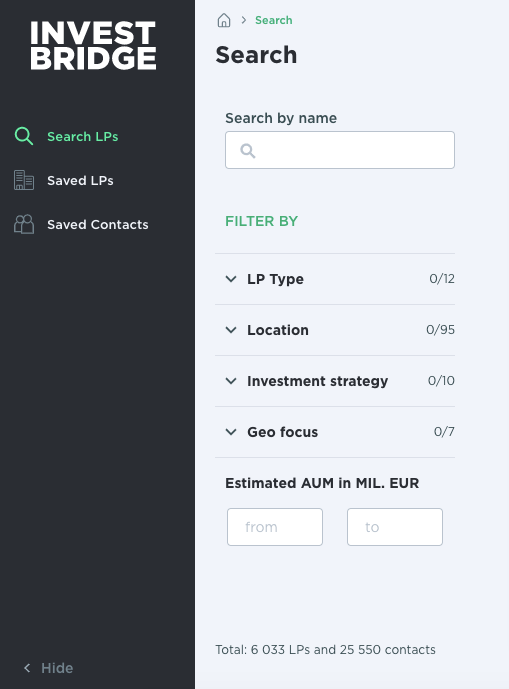

The investment landscape has already started the process of moving to a digital business. Also, we at InvestBridge, understand that the way how fund managers will be raising capital is changing and getting more digitalized. We want to make sure that we are part of the digitalization process by offering you even more exclusive ways how to find the right potential partners. In the first phase, we are bringing you a comprehensive database and an interface where you can filter more than 6,000+ LPs and 25,000+ contacts.

VISION

Our long- term goal is to connect the right Limited Partners and General Partners in Private Equity and Venture Capital digitally. A complex database is just a starting point, and we plan to build smart matchmaking tool for LPs and GPs with the primary aim to digitalize the process of fundraising and to help GPs and LPs to connect globally in these unprecedented times.

What Differentiates Us from Other Databases?

PRICE

InvestBridge allows you to access more than 25,000 contacts at a reasonable price saving your costs for paying additional services associated with research and data analytics.

SPECIAL PRICE FOR THE FIRST 20 CUSTOMERS – 50% DISCOUNT

See what InvestBridge has to offer with our tour that highlights major platform features.

REQUEST DEMO at pavol@0100conferences.com

EASY TO USE FEATURES

Thanks to InvestBridge database, you can effortlessly search for LPs you want to get in touch with by using the essential filters:

1. LP Type

Are you looking for Family Office, Pension Fund or Fund of Funds? Our user- friendly filters will help you to find the right type of Limited Partner.

2. Investment Strategy

Whether you are private equity, venture capital, fund of fund, or secondaries fund manager, you can find the proper LP of your preference. We filtered Limited Partners by their strategy-focus.

3. Geography Focus and Office Location

Ever wondered who the LPs are in your region? Which investor invest more in Western Europe compared to the US or Asia? Look no further and filter through the companies according to your taste.

YOU GET TO KNOW KEY PEOPLE

Connect with key people directly via our system. Browse through their LinkedIn profiles or Twitter accounts to get to know them well enough before you reach out. InvestBridge will help you to extend your LinkedIn connections with PE professionals.

THE INVESTBRIDGE FEATURES - Use powerful filters to navigate through the data. Our Solutions - Your Success.

CONTINUOUS IMPROVEMENTS

InvestBridge is still in MVP stage, however, our team listens to your feedback carefully and improves the database on demand and the accuracy of data continuously.

InvestBridge database will help you to get critical information about investment strategies of LPs and to save you time and money.

Find Your Next Big Opportunity at InvestBridge

Save Your Time & Money

Register Now