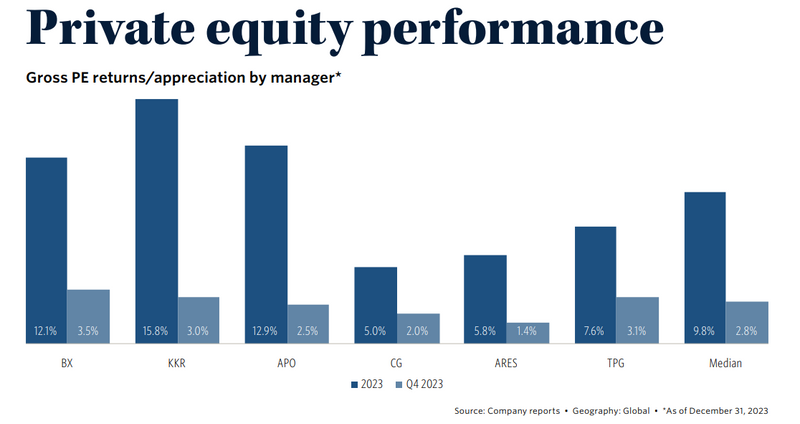

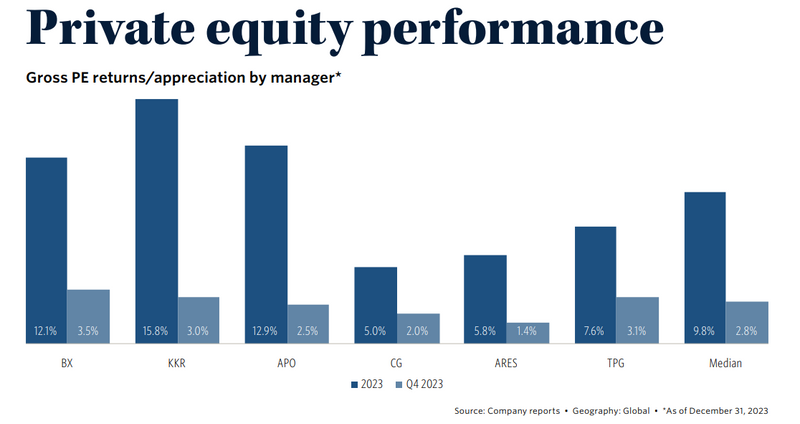

In a remarkable rebound, the top seven US-listed alternative managers have demonstrated robust performance in private equity (PE) with a median gross return of 9.8% for 2023. After a challenging period marked by consecutive negative quarters in 2022, the asset class has nearly reached double-digit territory. According to PitchBook’s US Public PE and GP Deal Roundup Q4 2023. The positive trend persisted into Q4, marking the fifth consecutive quarter of positive returns, with a median gross return of 2.8%. Although the one-year return of 9.8% lags behind the S&P 500's 26.3%, it indicates a significant return to form for an asset class that played a crucial role in the early growth of these managers.

Leading the charge is KKR, boasting an impressive gross return of 15.8% in its traditional private equity strategy for 2023. KKR's consistent strong quarterly performances and a 3.0% return in Q4 have positioned it favorably, surpassing Blackstone's reported return for its corporate private equity strategy for the same period.

Deployment Trends in Q4

The final quarter of 2023 saw a substantial surge in PE deployment, indicating renewed enthusiasm for dealmaking. The top seven alternative asset managers experienced a significant 57.6% increase in deployment from Q3, amounting to nearly $20.4 billion in invested capital. While this surge marked the highest deployment of the year, it also represented a slight 0.7% decrease year-on-year.

Apollo and KKR emerged as the most active firms in deploying capital to PE strategies throughout 2023. TPG, unique in its increase for the year, showcased the industry's revived interest in dealmaking. Blackstone, with a significant step-up in Q4 deployment, expressed its plans to activate new equity funds in the coming quarters.

Despite the robust performance in Q4, the full-year deal activity saw a decline of 19.0% year-on-year. This decline underscored the challenges faced throughout 2023, including elevated financing costs, constrained credit access, and geopolitical tensions. However, the outlook for 2024 appears promising, with stabilized inflation, potential easing of financing costs, and a significant backlog of deals.

Surge in Private Credit

In parallel with PE deployment, private credit experienced a surge in Q4 2023, with the seven managers collectively deploying $81.8 billion, marking a significant 65.3% increase quarter-on-quarter. Contributing factors included abundant private credit dry powder, bank conservatism, and lower volatility.

Apollo led the private credit category with $30.0 billion of debt origination in Q4, showcasing resilience and diversification. Blue Owl demonstrated remarkable growth with $8.1 billion in credit originations, reflecting optimism for future trends.

Ares Capital reported a sharp uptick in private credit deployment, while Blackstone experienced a notable increase in Q4. KKR's deployment in alternative and liquid credit strategies doubled sequentially during Q4 2023, demonstrating the industry's adaptability to changing economic landscapes.

Manager Insights and Portfolio Performances

Managers reported stable-to-improving performance in their underlying portfolio companies in Q4 2023. Blackstone indicated 7% revenue growth year-on-year, and Ares highlighted a significant uptick in TTM EBITDA. Blue Owl, positioned in the software direct lending space, reported firming EBITDA growth.

KKR expressed confidence with nearly $100 billion in dry powder, indicating a well-positioned outlook for 2024. Carlyle noted attractive deployment opportunities outside of corporate PE, and Ares expressed optimism for higher levels of deal activity in 2024, driven by lower rates and better economic growth.

Private Equity Realizations in Q4

The closing quarter of 2023 saw private equity (PE) realizations unfold amidst a nuanced economic backdrop. Blackstone, KKR, and Ares, among the top players, displayed variations in QoQ realizations, with a modest 1.5% median growth across the group. The subdued total trailing twelve months (TTM) activity, with a median decline of -40.3%, reflected challenges attributed to an unfavorable monetization environment persisting throughout the year.

Carlyle faced a substantial 59.1% decline in PE realizations on a TTM YoY basis, citing a weak third quarter. The notable exit of Saverglass from Carlyle Europe Partners IV fund contributed to a QoQ surge in Q4, emphasizing the quarterly variability in the industry.

Apollo demonstrated resilience with a 55.7% growth in Q4 PE realizations, positioning itself slightly above the group median for the full year. However, the TTM figures revealed a 41.2% dip compared to its 2022 performance, echoing the broader trend of cautious monetization in a challenging exit environment.

TPG experienced a significant QoQ decline of 77.2% in Q4 realizations due to the successful sale of Creative Artists Agency in the previous quarter. The firm's focus on value creation in its portfolios and selectivity in exit activity remained evident during its Q4 earnings call. TPG anticipates an uptick in realizations in 2024 as market conditions normalize, creating more opportunities for liquidity.

Ares showcased a Q4 QoQ drop of 11.7% in PE realizations but noted a substantial 73.0% increase in full-year realization activity. The anticipation of accelerated realizations through its European waterfall funds in 2024 signals optimism despite uncertainties about the market's impact on realization timing.

Blue Owl's GP Strategic Capital (GPSC) strategy stood out with a remarkable 1,019.1% increase in Q4 distributions, emphasizing the strength of its GP solutions product, particularly in the large-cap manager segment. Blue Owl's approach, focused on the resilience of larger GPs amid fundraising challenges and consolidation trends, contributed to its notable performance.

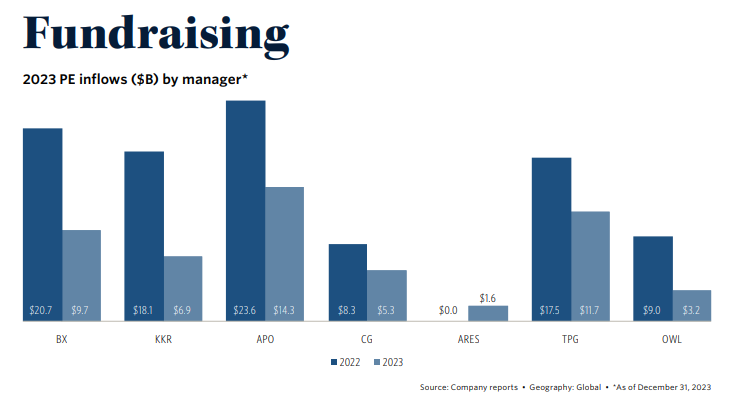

Fundraising Dynamics in 2023

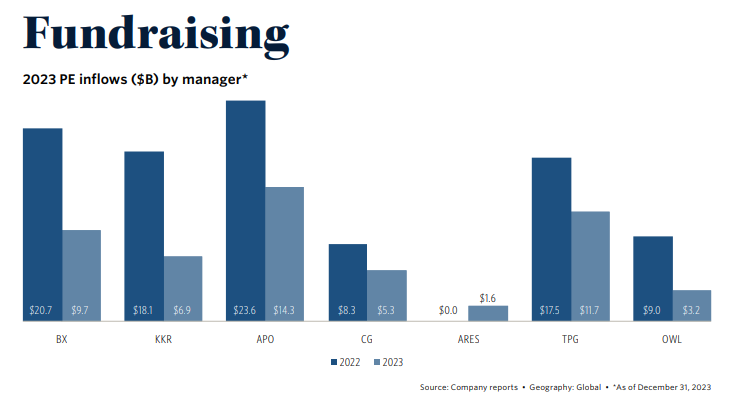

Navigating a challenging fundraising landscape, 2023 tested the resilience of large public alternative managers. Blackstone, with its Blackstone Capital Partners IX fund, adjusted its target to $20 billion, reflecting the industry trend of revising fund size targets. TPG closed its flagship fund at $12.0 billion, below the initial $15 billion target, mirroring the broader difficulty in raising capital for PE funds.

Despite challenges, the combined fundraising efforts of the top seven PE firms surged in Q4 2023, reaching an impressive $168.7 billion—a 60.7% increase from the previous quarter. Credit strategies dominated the fundraising mix, capturing 59.1% of the total, followed by real estate at 19.4% and corporate PE at 13.0%.

Individual firm performances varied, with Ares and Carlyle standing out with YoY fundraising growth of 34.5% and 24.1%, respectively. Blackstone led the Q4 charge with $52.7 billion, emphasizing its diversified product offerings and capitalizing on growing demand for private credit strategies.

Embracing Perpetual Capital and Private Wealth Strategies

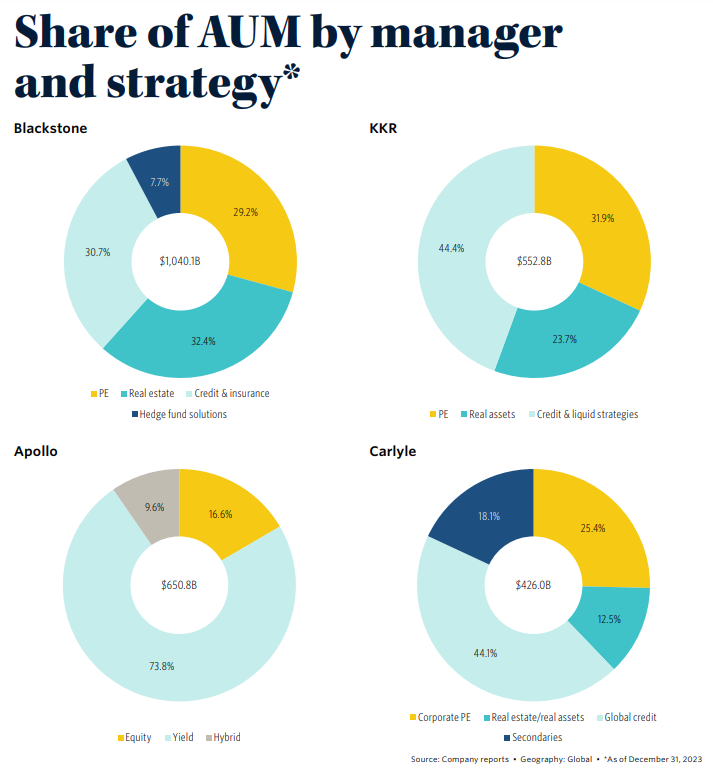

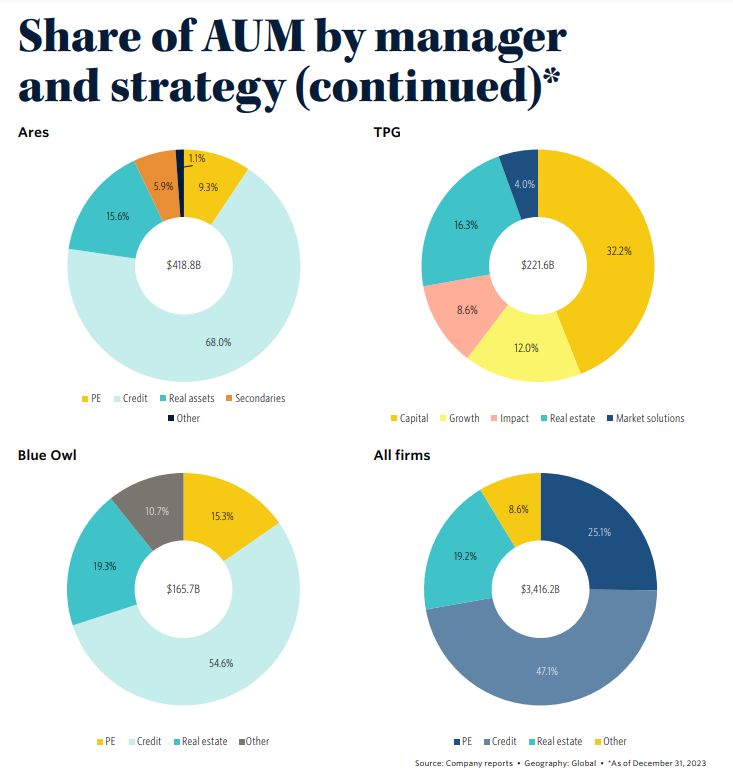

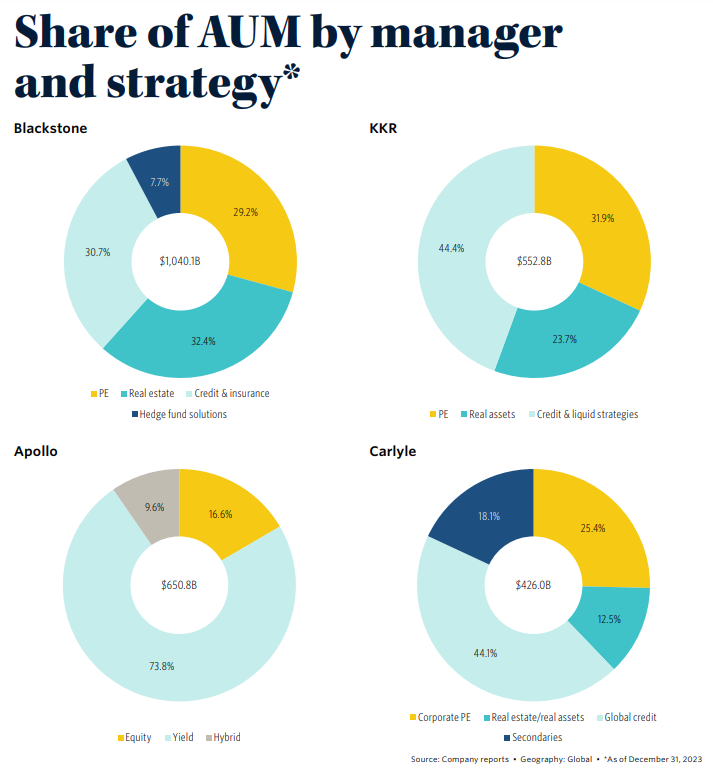

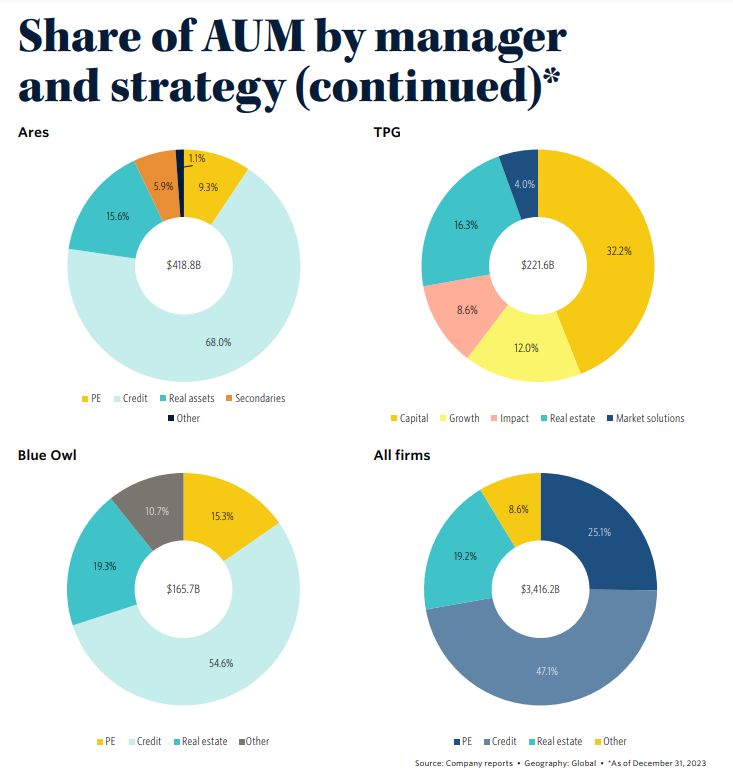

The quest for perpetual capital franchises continues among the top public PE managers, offering flexibility and a consistent revenue stream of performance fees. As of Q4 2023, assets in perpetual strategies totaled $1.4 trillion, representing 42.4% of total AUM for the seven publicly traded alternative managers.

Blackstone maintained its lead in perpetual capital AUM, reaching $396.3 billion, up 6.8% YoY. Apollo added $26.0 billion in perpetual AUM, while KKR, Blue Owl, and Ares also witnessed growth in their perpetual capital portfolios.

The insurance channel remained pivotal for growth, with firms like Blackstone, KKR, Apollo, Carlyle, and Ares leveraging this avenue. Blackstone's $36 billion raised through its insurance channel in 2023 exemplified the strategic importance of insurance for AUM growth. Apollo, in particular, highlighted insurance-driven inflows, accounting for nearly half of its organic inflows throughout the year.

The Magnificent Seven's Pursuit of Growth

The seven major public alternative asset managers, akin to the industry's "Magnificent Seven," showcased a robust commitment to expanding their businesses during Q4 2023. Earnings calls resounded with strategic initiatives, including the launch of new products, scaling of younger strategies, and geographical and asset class expansions.

Apollo's Vision for the Future

Apollo, a prominent player in the sector, emphasized the need for innovation to propel its capital formation. Recognizing the evolving market dynamics, Apollo plans to diversify by expanding its private credit offering, boosting debt origination platforms, and introducing new access points for retail investors.

TPG's Diversification Journey

TPG, on the other hand, marked a significant milestone with its acquisition of AG in November 2023. This move positions TPG as a diversified global alternative asset manager, particularly strengthening its presence in credit investing, real estate, and Asia. The acquisition opens doors for TPG to introduce its LPs to AG's credit teams, fostering further capital formation.

Private Wealth: A Lucrative Frontier

Private wealth emerged as a focal point for these industry giants. KKR, despite boasting around 40 platforms in the space, believes it's still early days in tapping into the vast private wealth market. With impressive fundraising numbers, the industry anticipates numerous product launches catering to the wealth channel.

Blackstone's Multifaceted Growth Approach

Blackstone's prowess was evident through its private wealth channel, with BCRED and BXPE each raising over $1 billion in January alone. The firm also drove growth through its credit & insurance arm, accounting for over 40% of Q4 fundraising. Blackstone's strategic focus extends to infrastructure, with its platform growing to over $40 billion in six years.

Diverse Strategies in the Spotlight

Firms like Carlyle extended their reach into adjacent strategies such as infrastructure. Carlyle's emphasis on the private student loan portfolio acquisition showcases a commitment to filling gaps left by traditional lenders. Blue Owl, meanwhile, diversifies its business, scaling through acquisitions and eyeing the healthcare credit market.

GP Deal Activity Insights

In the realm of General Partner (GP) deal activity, 2023 witnessed 92 deals involving GPs as targets, reflecting a 9.8% decline. Despite this, strategic M&A remained robust, with control transactions accounting for 48.9% of deals. Notable transactions, including TPG's acquisition of Angelo Gordon, shaped the industry's landscape.

Outlook for 2024: BlackRock's Record-Breaking Acquisition

The year 2024 commenced with a landmark event—BlackRock's $12.5 billion acquisition of infrastructure manager Global Infrastructure Partners. This monumental deal, the largest in the alternative space, underscores the industry's resilience and adaptability, setting an optimistic tone for the year ahead.

In summary, Q4 2023 witnessed the "Magnificent Seven" navigating through a complex landscape, strategically positioning themselves for growth in private wealth, diversified strategies, and transformative acquisitions. As the industry adapts to evolving trends, the outlook for 2024 appears promising, marked by groundbreaking deals and continued expansion.

We are pleased to have PitchBook as our official Data Partner for the upcoming 0100 Conference Europe. Elevate your experience at the conference with exclusive PitchBook access, available from March 27th to April 23 rd , 2024. As the official Data Partner, PitchBook provides comprehensive insights and attendees, companies, deals, investors, and funds. Maximize your time at the conference by viewing the attendee list to identify connections, prepare for meetings and enhance networking.