There are many strategies for PE & VC deal sourcing. However, as the market becomes more crowded and competitive, private equity players need to find new ways to source deals.

Have you thought about conferences as a deal sourcing channel? See our recommendations that you can leverage to attain new opportunities:

1) Stay in touch with co-investors and other industry players

Staying in touch will ensure that you build strong relationships with critical individuals, including other investors, startup founders, investment advisors, etc., who might refer you to your next deals. Industry events are one of the most effective ways how to follow up with them in a short amount of time.

2) Grow your network

Any successful deal sourcing strategy requires the broadening of your current network. It's crucial for searching for investment or acquisition targets and creating watchlists of companies. Paradoxically, the Covid-19 restrictions have created a worldwide online marketplace. There is no easier way how to grow your network than joining a virtual conference where you can connect with more than 500 PE & VC professionals including 300+ investors from all over the world within a few days.

3) Keep track of strategic advisors

Investors are always trying to minimize unnecessary risk and one of the most effective ways to do this is to perform due diligence and reference check potential investments. Attending conferences, you can effectively track the strategic advisors to enable fast outreach when you need to engage with them for due diligence.

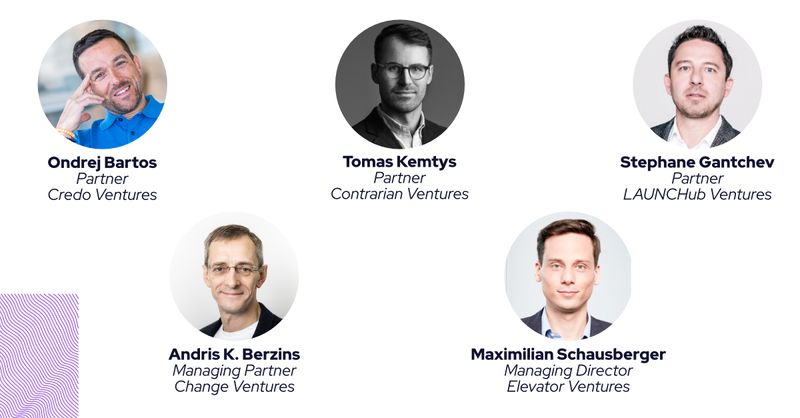

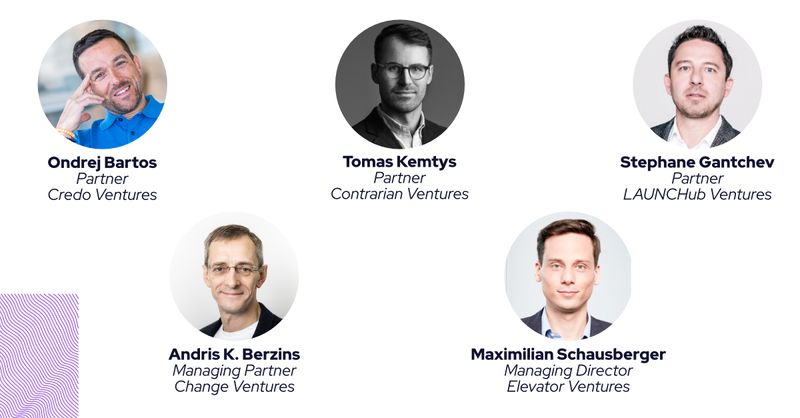

Our tips described here can help you unlock new opportunities. However, if you are looking for more comprehensive insights, join our VC Deal Sourcing panel discussion at 0100 Virtual CEE (16-18 March 2021). You can look forward to the following experts:

Ondrej Bartos, Partner at Credo Ventures

Tomas Kemtys, Partner at Contrarian Ventures

Stephane Gantchev, Partner at LAUNCHub Ventures

Andris K. Berzins, Managing Partner at Change Ventures

Maximilian Schausberger, Managing Director at Elevator Ventures

Source:

Image source: